Numbers, facts, stats, and data. Complex concepts such as mobile payments, blockchain networks, and peer-to-peer payment services. Not to mention, cryptocurrency trading and automated portfolio management.

That’s the kind of information businesses in the fintech industry must convey to their target audiences. And let’s face it. Not everyone gets excited about numbers.

But there’s a way to bridge that gap and increase adoption for fintech offerings. It’s through content marketing.

In this blog post, we’ll look at the different aspects of content marketing and how each aspect can supercharge adoption for your fintech solutions and increase customer engagement. Plus, examples of fintech companies that are doing content marketing right.

Benefits of Content Marketing in Fintech

Content marketing uses various types of content to educate and inform a target audience. These can come in the form of:

- Blog posts

- White papers

- eBooks

- Videos

- Podcasts

- Interactive content

By consistently publishing helpful and engaging content, fintech companies can position themselves as industry thought leaders. This builds trust, which is necessary to increase sales, customer satisfaction, and brand loyalty.

Aspect #1: Thought leadership in content marketing

For fintech companies to thrive, consumer trust is a fundamental tenet they cannot afford to overlook.

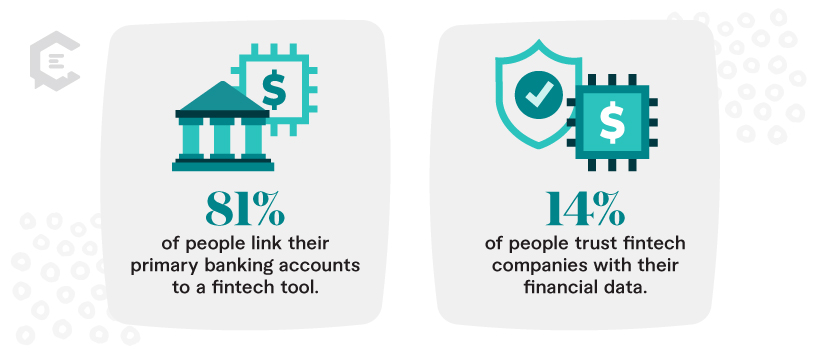

One survey found that 81% of people link their primary banking accounts to a fintech tool. But only 14% trust fintech companies with their financial data.

You build trust primarily through transparency, security, honesty, and reliability. Not only should fintech companies implement robust security solutions to safeguard financial data. But they should also communicate how these solutions safeguard data and what steps customers can take to protect it.

Strategies for implementation

Blog posts, white papers, podcasts, and video tutorials are all content types you can incorporate into your financial content strategy. You can leverage each one to educate your audience on:

- Data security

- The technology behind your solutions

- Money and asset management best practices

- How your solutions can help them better manage their financial processes

Consistently publishing helpful content that can make your customers’ financial lives easier builds your reputation as a go-to advisor. Your audience’s trust in you over your competitors can increase the adoption of your products and solutions.

Aspect #2: SEO-optimized content

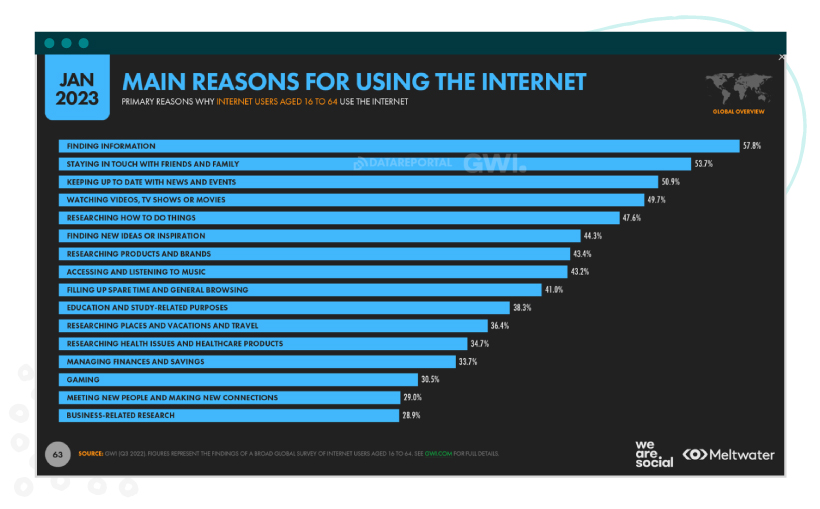

The search engines process billions of searches per day. Roughly 58% of those searches are for finding information online. This underscores the importance of search engine optimization (SEO).

Search-optimized content strategically uses keywords and takes into account user intent. This helps improve search visibility and site ranking, which drives organic traffic to your website. Increasing your chances of acquiring new customers.

Strategies for implementation

When optimizing your fintech content for SEO, consider the following best practices:

- Think beyond keywords: Keywords are extremely important in SEO, but they’re not the be-all and end-all. Content quality, readability, and structure are equally important.

- Create content that addresses user pain points and answers complex queries: Publish helpful content that aligns with user search intent.

- Optimize your content for mobile users: More than half of all web traffic comes from mobile phones. Implement mobile-first design strategies to keep your audience engaged. For example, avoid hard-to-read or small fonts.

- Think E-E-A-T: E-E-A-T stands for experience, expertise, authoritativeness, and trustworthiness. This is particularly critical for “your money or your life” (YMYL) content. These types of content can affect a person’s money or life.

- Incorporate video content: Video marketing can increase user understanding of your products and services. That’s according to an overwhelming 96% of video content marketers. Videos also improve SEO metrics, such as time spent on the page and the number of backlinks pointing back to a domain.

- Leverage pillar pages and topic clusters: A pillar page is a content hub that serves as the foundation for a topic cluster. It covers various aspects of a topic on a single page. A topic cluster is a collection of related articles or blog posts. Together, they provide an in-depth understanding of a specific topic.

Aspect #3: Social media engagement

Social media engagement refers to the response generated by content shared on social media platforms. Indicated by the number of likes, shares, comments, mentions, retweets, and clicks.

It gauges whether your content is:

- Resonating with your target audience

- Generating conversations

- Encouraging users to take action

Benefits to fintech adoption can include:

- Increased reach: When users engage with your content on social media, they extend your content’s reach to their followers and connections. This exposes your content to a much wider audience.

- Brand awareness: The more people engaging with your content on social media, the better for your brand’s visibility.

- Relationship building: Social media enables marketers to address user questions and respond to feedback. This builds relationships and creates a sense of community around your brand.

- Audience insights: Use tools such as Buffer or Hootsuite to track engagement metrics, such as likes, shares, and comments. This helps you gain deeper insights into the types of content your audience prefers, information that can guide future financial content marketing campaigns.

Strategies for implementation

To increase engagement on social media, here are some tips:

- Know your starting point. Analyze your current engagement metrics. Number of followers, average number of comments and shares per post, click-through rate (CTR), etc. Monitor them for spikes or dips in engagement to understand what’s working and what’s not.

- Define your goals. Every goal has a related social media engagement metric. For example, keep track of follower growth if you want to grow your follower base. Depending on the social analytics platform, follower growth can also provide insights into demographics like age, income, social habits, etc.

- Know your audience. Your audience will dictate the types of posts to publish — e.g., mobile payments vs. insurance — and the best social media platform to reach them. If you’re targeting professionals, LinkedIn may be your best bet. If you want to reach younger audiences, TikTok and Instagram may be the way to go.

- Respond to comments or questions right away. Make sure your responses are thoughtful and informative. This increases customer satisfaction and boosts brand trust.

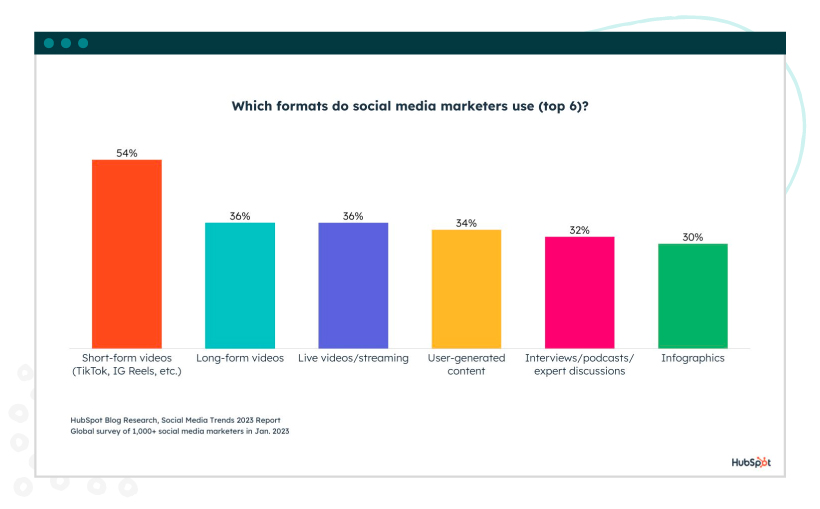

- Create valuable, shareable posts. According to a survey by HubSpot, short-form video is the top content type social media marketers will leverage this year. Other types are long-form and live videos, user-generated content, podcasts, and infographics.

Aspect #4: Data-driven content strategies

Data-driven content marketing leverages data and analytics to create more impactful content. It can also help you measure your finance content marketing success and shape your distribution strategy.

No more resorting to guesswork or intuition to encourage fintech adoption and customer engagement.

Strategies for implementation

A data-driven content strategy involves the following key components:

- Data collection and analysis: Collect data about your audience, such as demographics, interests, and online behavior. Data sources can include social media platforms, web analytics, market research, and customer surveys. Analyze these data points for insights into their challenges, preferences, and consumption patterns. This informs the types of content that will resonate with them.

- Content ideation, creation, and optimization: Identify relevant keywords, trending topics, and gaps in the market that your content can address. Generate content that aligns with your audience’s needs. Optimize existing content based on SEO best practices and by analyzing the performance of previous content.

- Content distribution: Use relevant data to find the most effective channels, times, and frequency for content distribution.

- Performance measurement and improvement: Track and analyze content performance against metrics such as time on page, page views, CTR, social media engagement, and conversion. Continuously track, analyze, and improve content over time.

Case studies: Fintech Content Marketing That Works

For ideas into the types of fintech content and marketing strategies that resonate with target audiences, let’s take a look at some case studies:

Wise

Formerly TransferWise, Wise is a money transfer platform. It offers low-cost transfers from the U.S. to most countries around the world. Wise’s personal finance category of content teaches readers how to open or close a bank account with competitors.

This leverages long-tail keywords such as “how to close X bank account.” Keywords such as these signify that the user may be looking for other options. This may sound like Wise is putting the spotlight on competitors. But by owning the narrative, Wise can strategically mention its own product within the content.

Some examples:

- How to close your St.George bank account and move your money out

- How to delete a PayPal account in Australia

- How to open a bank account in China as an Australian

Checkout.com

Checkout.com is a digital payment processor used by companies such as Sony, Shein, and GE Healthcare. To increase adoption, it features its own customers’ success stories in an easy-to-navigate case studies repository.

Each case study touches on the customer’s pain points and how Checkout.com is helping alleviate those challenges.

Some examples:

- How the Financial Times creates a friction-free subscription experience

- GE HealthCare puts Checkout.com at the heart of its e-commerce expansion

- How We Are Knitters saves on foreign exchange costs and scales efficiently

The Transformative Impact of Fintech Content Marketing

To build trust and drive adoption, fintech companies must simplify complex topics to make them accessible to wider audiences. Content marketing enables them to do just that in a way that encourages customer engagement.

At ClearVoice, we have an on-demand pool of experienced finance writers to help you:

- Establish authority

- Educate your target audience

- Empower your customers to use your products and solutions with confidence

Contact us for a free content strategy session with a ClearVoice specialist.