Investment management is a fiercely competitive space.

Firms compete for the same set of customers. To stand out, they need a solid content marketing strategy. One that enables them to consistently produce high-performing content that checks all the compliance boxes. Then, they must measure and optimize content for maximum effectiveness.

In this article, we take a look at:

- Content marketing opportunities and challenges for investment management firms.

- Different content marketing strategies you can start implementing today.

- The metrics to track to effectively measure content marketing success.

Investment management content marketing: Opportunities and challenges

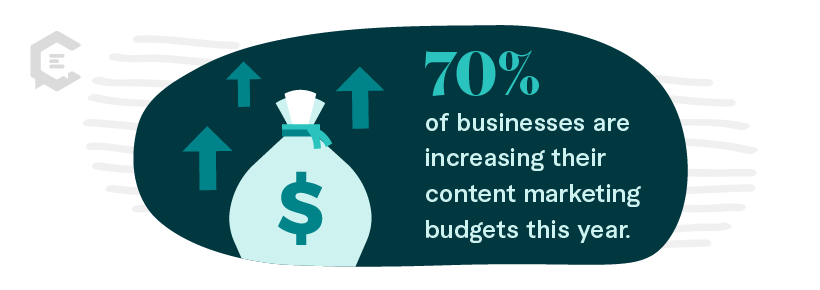

Even with a potential global recession, approximately 70 percent of businesses are increasing their content marketing budgets this year.

That’s because content marketing comes with numerous benefits. From authority building to client retention. Investment management firms can tap numerous opportunities through content marketing:

- Build trust. Informative, high-quality content published consistently solidifies your firm’s credibility. It establishes your reputation as a go-to thought leader in the space. This builds trust with potential clients. Hence, making them more likely to choose your services over the competition.

- Establish thought leadership. Content marketing provides numerous opportunities to showcase your knowledge and expertise. Do this through educational content, original research, expert commentary, and market insights.

- Educate target audiences. Help your target audience understand complex concepts with educational content. Explain in plain language what the investment management process looks like. Talk about the different investment vehicles and their risks and returns. Empower them to make informed decisions and avoid emotional investment mistakes.

- Nurture relationships. Publish valuable investment management content consistently. This keeps you top of mind with current clients and can lead to client referrals.

- Generate leads. Great content can attract potential clients to your website and other online assets. This allows you to move them through the marketing funnel until they convert into paying clients.

But as is typical of the financial industry, investment management also comes with unique content marketing challenges:

- The complexity of content. Technical terms and specialized jargon are hallmarks of the investment management industry. This can alienate the average reader. Create content that simplifies complex concepts while providing comprehensive information.

- Compliance constraints. Finance is a heavily regulated industry. Firms must carefully watch the language they use and the claims they make. This necessitates a thorough review process that may slow content production and promotion.

- Difficulty measuring return on investment (ROI). This is due to a host of factors. First, the sales cycle can be long, particularly for high-value products or services. A piece of content may generate leads. But the actual conversion can take months or years. This makes it challenging to directly attribute revenue to content marketing. Second, conversion may require multiple touchpoints. And content marketing is just one of those many touchpoints.

- Competition. Investment management is highly competitive. Everyone is vying for the same customer’s attention. As such, creating stellar, standout content is essential.

- Frequent updates. Financial markets are highly dynamic. Content will require regular updates to remain fresh, relevant, and accurate.

Top content marketing strategies for investment management firms

Investment management companies have to do it right to reap the benefits of content marketing. Let’s take a look at the different content marketing strategies your organization can start implementing today.

Educational and insightful content

Current and prospective clients will come to you for various reasons. Some questions they may ask:

- Which investment options are suitable for me?

- How can I diversify my portfolio?

- What are the impacts of the current economic environment on my investments?

- What risks are associated with different investments?

- How can I achieve my financial goals?

- How do I plan for retirement?

To address their questions and concerns, consider the following content types:

- Market commentary and insights. Have experts share their insights and perspectives on recent market developments. What do these developments mean for investors? Create written or video-based commentaries.

- Quarterly and annual market reviews. Highlight investment successes and challenges over the past year or quarter. Create comprehensive reviews that discuss the period’s economic conditions, market performance, and key events.

- Investment outlooks. Publish investment outlook reports that present short-term and long-term expectations for global markets and various asset classes.

- Asset allocation strategies. Provide insights into the different asset allocation strategies. Include information on the benefits of diversification and how to align investments with specific risk profiles.

- Special reports on market events. Create special reports analyzing major market events and their potential investment impacts. These can include geopolitical developments, economic crises, or shifts in monetary policy.

- Comparative studies. Help clients make informed decisions through comparative studies of various investment strategies or vehicles. Compare their risk and return profiles.

- Infographics and data visualizations. Present complex data in a visual, easily digestible format. This makes your content more accessible to a wider audience.

Thought leadership and industry insights

Thought leadership establishes credibility. And when it comes to their money, clients are more likely to trust recognized industry authorities.

To position your investment firm as a thought leader and industry pillar, it’s not enough to create only educational, informative content. You also need to:

- Publish original studies and research. Publishing original research offers several benefits. For instance, it demonstrates expertise and differentiates your firm from competitors. As well, original, in-depth analysis can support the investment strategies your firm recommends. And if your findings are notable, your research can attract media attention.

- Contribute to publications. Contribute guest articles or expert commentaries to industry publications or popular financial blogs. This enhances your firm’s visibility and audience reach.

- Seek networking and speaking engagements. Join industry conferences, webinars, podcasts, or seminars as a speaker or panelist. This not only establishes your firm’s authority in the field. But it also allows you to engage directly with potential clients.

Personalization and client-centricity

According to a McKinsey report, customer intimacy equals faster revenue growth rates. “The closer organizations get to the consumer, the bigger the gains.”

This is why personalization in content marketing is paramount. You want to consistently deliver content that speaks directly to your audience’s needs.

You can do this through:

- Client segmentation. Segment your audience based on criteria like age, investment goals, investment preferences, and risk tolerance. Create content tailored to the unique requirements of each segment.

- Targeted email marketing. Deliver personalized content using targeted email campaigns based on the various segments.

- Feedback and dialogue. Foster open communication with your target audience. Seek their feedback through tools such as surveys and interviews. Ask about the topics they find most valuable. Monitor their interactions on social media. Encourage comments and reviews, and make sure to respond to questions promptly.

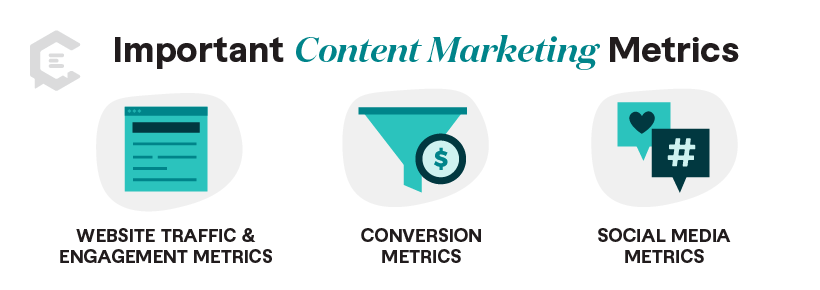

Measuring success: Analytics and metrics in content marketing

Content marketing success metrics are measurement standards that show how well your content marketing is doing. They help you optimize your content strategies and make data-driven decisions.

When choosing your success metrics, consider your business objectives. Your metrics should directly contribute to your broader business goals. Whether that is to generate leads, increase brand awareness, or improve customer retention.

Here are some of the most important content marketing metrics to note:

Website traffic and engagement metrics

- Web traffic. Track your website’s total number of visitors and which sources drive traffic. These can include direct visits, organic searches, or website referrals. Also, traffic from social media, paid search, email marketing, affiliate marketing, and display advertising.

- Page views. You can identify which pages attract the most traffic by tracking page views. This can also determine which types of content resonate with your target audience.

- Time on page. This measures how much time visitors spend on a page. A high time on a page may indicate that visitors find the page’s content valuable and engaging.

- Bounce rate. Bounce rate is the percentage of visitors leaving your website after viewing just one page. A high bounce rate may indicate the content doesn’t align with their expectations.

Conversion metrics

- Lead generation. How many leads did your content marketing efforts generate? Leads generated can take the form of newsletter signups, contact form submissions, and gated content downloads.

- Conversion rate. This metric calculates the number of visitors who perform a desired action. Desired actions can include registering for a webinar, signing up for a free trial, and scheduling a consultation or discovery call. The conversion rate measures the effectiveness of your landing pages and calls to action (CTAs).

Social media metrics

- Engagement metrics. Track the number of social media comments, likes, and shares your content generates. These metrics gauge how well your content resonates with your target audience.

- Follower growth. Follower growth measures how much your subscriber or follower count has increased over a specific period. It indicates that your content is gaining popularity and your brand is becoming more visible.

ROI

To calculate ROI, compare revenue generated (or cost savings achieved) against content production and promotion costs. A clear ROI picture demonstrates the value content marketing brings to your firm. It can also help you justify content marketing expenses to higher-ups.

Investment management content marketing to increase investor engagement

As we have seen, content marketing significantly benefits investment management firms. Not only does it establish credibility and authority. It also enables investors to make informed decisions and avoid costly mistakes.

Need help consistently creating high-quality content to stand out in a crowded marketplace? Connect with a ClearVoice expert today to gain access to our pool of vetted financial writers.