When it comes to insurance, trust is the name of the game. And yet, many people eye insurance companies with the same suspicion they reserve for those “limited-time” sales that never seem to end.

But there’s a way to flip the script — content marketing.

By creating honest, helpful content, insurance companies can build the kind of trust that makes customers think, “Hey, these folks are actually on my side.”

Let’s dive into how you can make that happen.

Why Customers Don’t Trust Insurance Companies

Let’s face it: insurance companies don’t always get the warmest receptions. The horror stories of denied claims, convoluted policies, and surprise charges make customers feel like they’re navigating a minefield, not buying peace of mind. When customers don’t trust you, they’re less likely to buy from you or stick with your company.

According to McKinsey’s 2023 Global Insurance Report, trust is the secret that keeps customers around. Consumers who trust their insurance providers are like those loyal coffee drinkers who refuse to switch brands, even when another café offers a free croissant.

So, how do you become the brand they just can’t quit? Content.

How Content Can Help Bridge the Trust Gap

Content is a powerful tool to win back trust. Insurance companies can help customers feel more informed and secure by providing clear, truthful information. Good content can make a big difference, whether it’s a blog post explaining a tricky policy term or a video walking them through the claims process. It shows customers that you’re here to help, not just to sell.

For instance, an insurance company could create a series of explainer videos that walk customers through everyday scenarios, such as filing a claim after a car accident. By showing empathy and providing clear, actionable information, these videos can help to build trust and credibility and help reassure customers that the company is on their side.

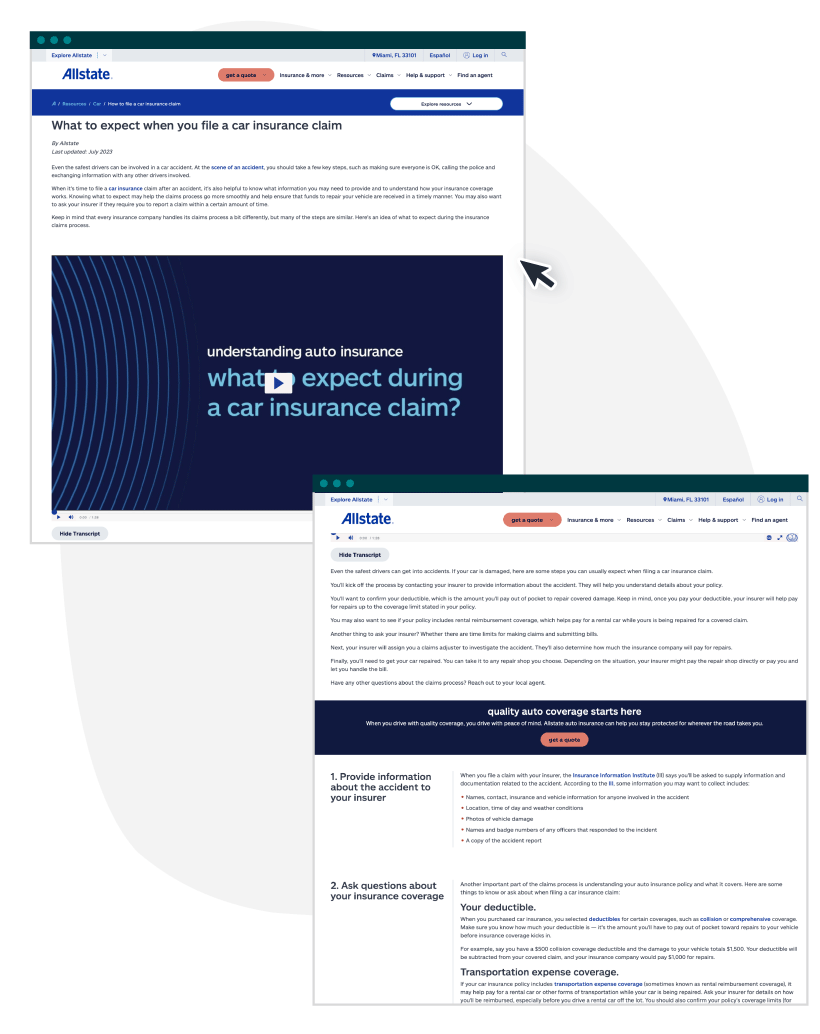

Take a page from Allstate’s book:

Source: Allstate

Allstate doesn’t just talk the talk — they walk the walk with quick videos and detailed guides on what customers can expect when filing an auto claim. That’s how you turn a nightmare scenario into a manageable situation.

3 Content Strategies to Build Trust

Building trust through content requires more than just surface-level efforts; it demands a genuine commitment to transparency, authenticity, and customer education. That’s especially true in the financial industry.

Here’s a closer look at these areas to help you create deeper trust and connections with your customers.

1. Be Transparent and Honest in Your Content

Don’t hide behind jargon or complicated terms. Comb through your marketing materials and published content and make sure you’re: 1. Explaining things in plain English, and 2. Telling customers exactly what they’re signing up for.

When people know what they’re getting, how much it costs, and how it works, they’re far more likely to feel comfortable doing business with you.

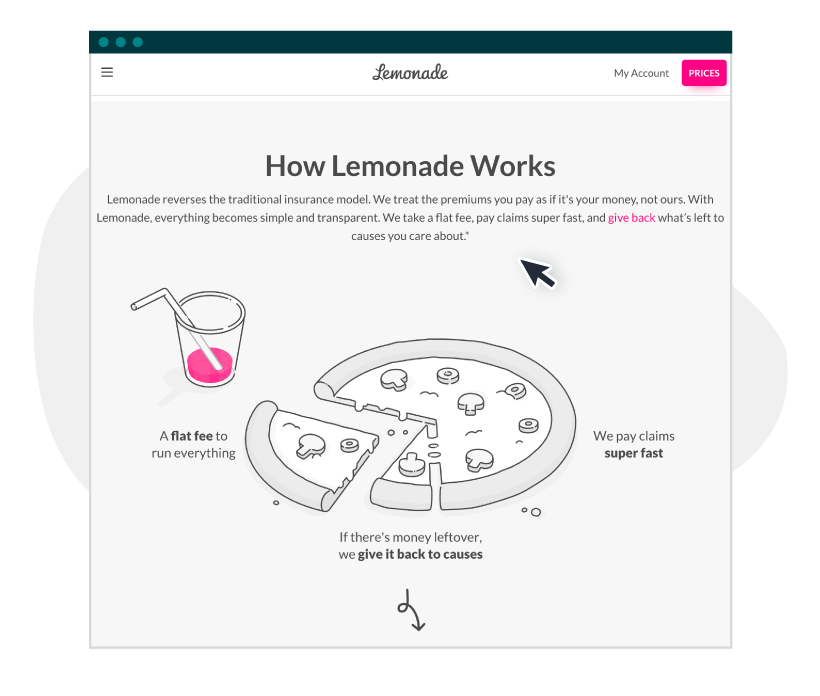

Check out how Lemonade handles this:

Source: Lemonade

Lemonade’s approach is as refreshing as, well, lemonade on a hot day. Its breakdown of how it works and treats your premium is jargon-free, conversational, and easy to understand. Customers can feel good that their premiums aren’t mostly being used to line the pockets of higher-ups.

2. Teach Customers Through Helpful Content

Who doesn’t love learning something new — especially when it’s useful? Position your brand as the go-to by sharing your expertise through blog posts, guides, webinars, and videos.

For example, you could create videos that walk customers through common scenarios, like filing a claim after a particularly gusty day causes a branch to fall and damage the roof. These videos can help customers feel more confident and show you’re on their side.

If you’re not sure what direction you want to take your content or what types of materials you should create, start a conversation with one of ClearVoice’s content experts. We’re here to help your team hit those goals and then some.

3. Put the Customer First in Your Content

Experienced marketers know the drill — solve problems, and make customers happy. But here’s a little something to kick your strategy up a notch: embrace the “Jobs to Be Done” (JTBD) framework. The what, you say?

JTBD digs into your customer’s core needs and motivations to find the why behind their actions. What’s the deeper “job” they’re looking for your content — and ultimately your product — to do?

For example, if someone’s digging into articles about insurance policies, they’re not just hunting for coverage details — they’re looking for peace of mind. They want to know their family’s future is secure. Nail this, and your content will speak to them on a whole new level.

Take a page from Farmers Insurance’s playbook:

Source: Facebook

Remember those Farmers commercials? They took real, sometimes downright bizarre, claims and turned them into entertaining stories that also gave customers confidence. No loopholes, no surprises — just honest coverage in a moment of need, even if a cement truck did trash your car.

Ways to Stand Out with Your Content

By consistently communicating what makes your company different, you can build a brand image that resonates with customers and reinforces trust.

Let’s dive into how you can achieve this through targeted content strategies.

Highlighting What Makes Your Brand Special

“I know, I know,” you say. “My brand needs to stand out.” But here’s something more you can do: harness the power of storytelling with “brand origin stories.”

Dive into the “why” of your brand’s birth. What sparked your founders to start this journey? By sharing the real stories behind your brand’s beginnings or those game-changing moments where you truly made a difference, you’re doing more than just listing features — you’re creating a connection that sticks.

Using Customer Reviews and Testimonials

Nothing builds trust like a good old-fashioned testimonial. But we’re not talking about boring, generic ones here. We’re talking about real-deal stories where your brand swooped in and made a life-changing impact.

These aren’t just feel-good anecdotes; they’re proof that you’re not just in it for the sale — you’re in it to make a difference. Show your customers the stakes, the action, and the outcome, and watch how it deepens their connection to your brand.

3 Tips for Creating Effective Content in Insurance

Creating effective content in the insurance industry requires a careful balance between education and promotion. It’s not just about what you say, but how you say it — and how you measure its impact.

1. Balance Helpful Content and Promotion

It’s important to strike the right balance between being helpful and promoting your products. Yes, you want to sell, but you also want to provide value. Ensure your content is a mix of helpful information that builds trust and promotional content that drives conversions.

A well-planned content calendar can help you keep this balance in check. Using the right features in tools like Trello, Asana, and CoSchedule can make a world of difference for this:

- Trello: Use color-coded labels to categorize content as educational, promotional, or both. Keep tabs on your content’s performance with a “Metrics” checklist on each card.

- Asana: The custom fields in Asana make it easy to track priority levels, content goals, and target audiences. You can even integrate it with Google Analytics or HubSpot to monitor performance right within the project.

- CoSchedule: CoSchedule’s ReQueue feature automatically republishes your best-performing content, ensuring proven posts continue to work their magic.

When you’re ready to bring your content calendar to life, ClearVoice’s team of vetted writers is here to help you hit your publishing goals, whether you need just a little extra help or all the help you can get.

2. Collaborate Across Departments

Your customer service, sales, and product teams are on the front lines every day. They know what customers are asking, where they’re confused, and what they’re worried about. Regular cross-departmental meetings allow you to gather these insights and shape content that directly addresses customer concerns.

Bi-weekly or monthly meetings where each team shares recent trends, feedback, and recurring issues can be goldmines for content ideas that truly resonate with your audience.

3. Track How Well Your Content Is Working

If you’re not tracking your content’s performance, you’re flying blind. Here are some tools that can help you see what’s working and what needs tweaking:

- Google Analytics: Set up custom events to monitor reader interactions. For example, track when someone downloads an eBook on life insurance or clicks a video about filing a claim. Turn on Site Search Tracking to see what people are searching for on your site — then create content that fills those gaps.

- Sprout Social: Sprout Social’s sentiment analysis tool lets you see how your audience reacts to different content types. Its cross-platform analytics also helps you figure out which social channels get the best results for specific types of content. Maybe educational content performs better on LinkedIn, while Facebook is your conversion machine.

- Ahrefs: Dive into Ahrefs Organic Keywords Report to see how your content performs in search engines over time. Spot declining keywords early, then go deeper into the report to understand what’s happening. The content could be outdated, not as comprehensive as competitors, or have a tone that no longer speaks to your audience. Once you know the issue, tweak your content to stay on top of the rankings.

Be Real and Watch Your Business Flourish

Building trust in the insurance industry isn’t just a nice-to-have — it’s a must. By focusing on transparency, honesty, and customer-first content, you can transform skeptical prospects into loyal customers who stick around and spread the word.

Trust isn’t built overnight; it’s like planting a tree. Water it consistently, nurture it with care, and give it time to grow.

If you’re struggling with the right content marketing strategy, connect with a content specialist for ideas on showing customers how you’re there for them at every step. Because when it comes down to it, trust is the foundation that keeps your business flourishing.