Even if you haven’t seen the 1976 classic Taxi Driver, you’ve probably heard DeNiro’s famous line: “You talkin’ to me?” He says it once, repeats it, repeats it again, and then finishes with, “Well, I’m the only one here!”

While the words jumping through DeNiro’s frown lips are cinematic rhetoric, they have a little more meaning for those finance managers hunting for solutions. They scroll past endless ads and blurbs boasting the innovative genius of capital market firms, but the question remains: Are they talkin’ to me? Do they understand what I am going through?

As a capital markets firm, you just want to say, “Yes. I’m talking to you. And here’s how we can make your job easier.”

But in the finance space, this is hard. Maybe the overlap between our audience’s job duties results in nebulous messaging. After all, aren’t all capital market target audiences made up of investors?

Well, no, it’s not that simple. And if you want to ensure each persona knows that you are definitely talking to them, here’s your guide to segmenting — then targeting — individual personas for capital markets firms.

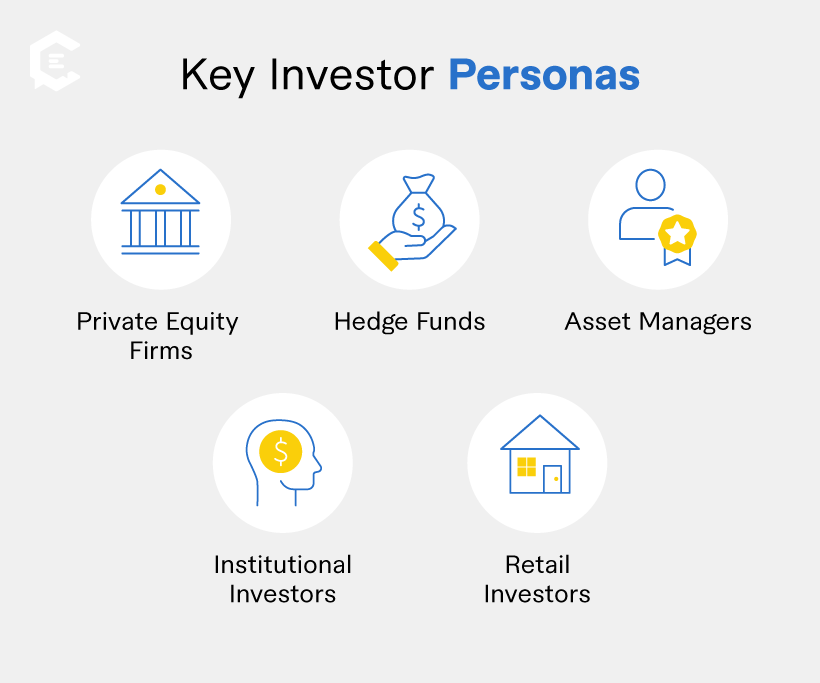

Understanding the Key Investor Personas

First, you have to identify who you’re talking to. Then, it’s easier to make your message resonate with each audience. Here are your target personas in a nutshell:

- Private Equity Firms

- Who they are: Investors in established companies with a focus on long-term value creation.

- What they want: In-depth insights on market trends, potential acquisitions, and due diligence processes to help them make well-informed investment decisions.

- Hedge Funds

- Who they are: Firms often pursue high-risk, high-reward investment strategies.

- What they want: Real-time data, advanced analytics, and insights into market volatility.

- Asset Managers

- Who they are: Professionals who oversee client portfolios to help achieve investment goals.

- What they want: Deep market research, performance metrics, and guidance on regulatory compliance.

- Institutional Investors

- Who they are: Entities like pension funds and insurance companies that manage large sums of money.

- What they want: Stable, long-term returns, transparent reporting, and proactive risk management strategies.

- Retail Investors

- Who they are: Individual investors using brokerage firms to buy and sell stocks and assets.

- What they want: Educational content, straightforward insights, and resources to make informed investment decisions.

Why Segmentation is Critical for Content Marketing

Segmentation makes choosing the services that appeal most to the audience easier.

Imagine this: You’re prepping for two dinner meetings — one with a private equity firm owner, the other with a retail investor. Would you prepare the same notes? Of course not. You’d end up sitting across from a DeNiro.

For the investor, maybe you’d focus on your firm’s brokerage services. You have a killer web app that live streams trading data and market news and also provides fundamental analysis via interactive charts and graphs.

For the private equity firm, you might talk about your bank’s company valuation team and tools. Your team has a combined 45 years of experience evaluating companies, and they have an AI-powered tool that predicts future value by analyzing revenue trends and debt-to-equity ratios.

Your content marketing should follow the same approach. Treat each audience like you’re having a one-on-one dinner, listening to their needs and tailoring your solutions. This is the essence of behavioral targeting: letting audience insights drive your marketing. Understanding the key investor personas makes it easy to envision who’s on the other side of the table.

Crafting Targeted Messaging for Each Investor Persona

Whether you’re a traditional bank trying to compete in the digital-first era or a newcomer to the capital markets space, you have to create content around your persona’s pain points. Here are some examples to help jumpstart your strategy:

1. Content for Private Equity Firms

- Case studies: Showcase successful investments and operational improvements achieved through private equity. Put key metrics and outcomes front and center to demonstrate your value add.

- Market research reports: Focus on emerging sectors, market opportunities, and competitive landscapes.

- White papers: Provide comprehensive analyses of private equity trends. Think regulatory changes, economic shifts, or technological advancements that could impact portfolio companies.

- Newsletters: Tantalize prospects with relevant news, insights, and case studies to keep them updated on industry trends.

2. Content for Hedge Funds

- Research papers on investment strategies: Flex your analytical muscle by digging into innovative trading strategies that hedge funds can employ to capitalize on market fluctuations. Algorithmic trading, quantitative analysis, and AI-powered insight engines will turn heads.

- Expert commentary and insights: Shoot for authenticity by publishing interviews or articles featuring hedge fund managers and analysts. Throw in their candid, raw takes as they break down strategies, make bold market predictions, and walk through lessons learned from recent trades.

3. Content for Asset Managers

- Market insights reports: Show you have your finger on the pulse of the markets by developing comprehensive reports that analyze current conditions, economic indicators, and strategies for success in the financial sector.

- Investment strategy guides: Step up as an authority and guide asset managers by outlining investment strategies. You can touch on hot topics like value, growth, or ESG (environmental, social, and governance) investing.

- Case studies on successful portfolios: This is where you get into the how. Show them how it’s done with case studies highlighting successful portfolio management strategies. You can focus on specific asset classes or let market conditions set the stage for each story. As always, weave in metrics and outcomes to illustrate the effectiveness of each win.

- Compliance and regulatory updates: Everyone appreciates a heads-up. Regularly publish articles or newsletters that address regulation changes that impact asset management.

- Thought leadership articles: Step to the front of the pack by publishing pieces about the impact of technology on investing, the rise of passive investment techniques, or what today’s clients expect.

- Client success stories: It’s OK to brag a little. As a capital markets firm, highlighting testimonials and success stories inspires confidence in asset managers, and as long as you highlight tangible numbers, you also build credibility.

Multichannel Distribution: Reaching Investors Where They Are

Even if you have incredible content, you must ensure they reach your audience. By using a multichannel strategy, you can engage each investor persona through the channels where they’re most active.

Identifying the Right Channels for Each Persona

Different investor groups have distinct preferences and behaviors that influence where they consume content and make decisions.

- Private equity firms: These investors often prefer webinars, industry conferences, and specialized publications.

- Hedge funds: Given their focus on quick decision-making, hedge funds may benefit from real-time data feeds, email updates, and articles that offer actionable insights.

- Asset managers: Since asset managers value comprehensive market research and analysis, you should give them tailored content through email newsletters, white papers, and in-depth reports.

- Retail investors: Retail investors are more likely to engage through social media, blogs, and mobile-friendly content. They need educational resources and insights that are easy to digest. To connect with retail investors, you can combine your content marketing with digital tactics using platforms like Instagram, Twitter, and investment-focused blogs.

Tailoring Messaging Across Channels

Each channel has its vibe, and you want to ensure your content jives with what people expect. For example, you may develop a social media campaign for retail investors. It would help to use a conversational tone and visuals to simplify complex concepts. Engaging posts with quick tips or infographics resonate well on platforms like Instagram and Twitter.

Measuring the Success of Segmented Content Strategies

So you’ve chosen your target audiences, made sure they hear your message loud and clear, and you’ve chosen their favorite channels. But how do you know whether your strategy is working? Here are some metrics for quantifying the success of each campaign and how to use them:

- Engagement Rates: Measure likes, shares, comments, and interactions on social media posts.

- Content Downloads: Track the number of downloads for white papers or reports tailored to asset managers and private equity firms.

- Webinar Attendance: Monitor registration and attendance rates for webinars aimed at different personas. This lets you know which topics resonate most.

- Lead Generation: Evaluate the quality and quantity of leads generated from various channels, assessing how effectively each channel converts interest into highly qualified prospects.

Optimizing Content Strategies Based on Data

Now, it’s time to use your data. For instance, suppose you create a series of articles aimed at asset managers. Each piece of content has a call-to-action (CTA) at the bottom that links to a contact form. When readers fill out the contact form, one of your sales reps gets it in their inbox and reaches out for a meeting.

As a result of your campaign, the number of asset manager leads your sales reps get grows 20 percent over six months. Given this growth, you decide to carefully analyze each piece of content’s topics, structure, and images. These then become tools that fuel your next campaign.

Fidelity Investments: Segmenting and Targeting Customers with Role-Specific Content

Fidelity Investments specializes in creating content that resonates with its target customers. Here’s a great example that illustrates their approach. Notice how Fidelity is:

- Specifying the target market, financial advisors, in the article title: “Growth marketing for financial advisors.”

- Outlining specific ways financial advisors can grow their business, such as lead generation, client insights and data activation, and promotion.

- Providing two complimentary infographics that illustrate how their organization helps financial advisors grow their businesses.

Use Precision Marketing to Attract More Business

With precision marketing, your target personas know who you’re talking to: Them. That’s because you base your content on their unique pain points. You also give them the kinds of content they like and use their favorite channels. By taking a multichannel approach, you amplify the impact of your targeted content. This drives better engagement and conversion rates by ensuring you reach customers where they are.

To start building targeted campaigns for specific market segments, reach out to ClearVoice’s specialists, who have experience creating effective content for capital markets firms. Connect with an expert today for a strategy session.