When people need to learn something, they turn to Google. Whether it’s “how to boil an egg” or “how to submit a health insurance claim.”

So, it should come as no surprise that content marketing and SEO are powerful tools for promoting financial literacy.

Learn more about how content marketing is empowering financial literacy. Plus, how to implement these practices effectively.

The rising need for financial literacy

Financial literacy refers to the knowledge of various financial concepts and tools. This literacy enables individuals to make informed and effective financial decisions.

Financial literacy can include a wide range of topics:

- Budgeting

- Saving

- Investing

- Borrowing

- Managing debt

- Understanding credit scores

- Planning for retirement

The need for greater financial literacy is clear. More than half of Americans can’t cover a $1,000 emergency expense with savings. Meanwhile, about 20 percent of employees run out of money before their next paycheck.

Additionally, U.S. adults correctly answered only 50 percent of the questions on the TIAA Institute-GFLEC Personal Finance Index in 2021, a noted measure of financial literacy.

Benefits of content marketing for financial literacy initiatives

Content marketing can help with financial literacy initiatives. Companies like Investopedia, Credit Karma, and Acorns already host robust learning hubs. These hubs provide free information about debt, investing, and saving.

A successful content marketing program can help financial information spread further. It also works more effectively than traditional routes like classes or books.

Improved engagement

By focusing on creating valuable, informative, and engaging content, you can attract and retain an audience interested in improving their financial literacy. Content marketing practices can make personal finance content more interesting and engaging.

Credit Karma offers an interactive “credit score simulator.” Some people may know the factors that affect credit scores (like debt and credit history). However, the simulator provides an exciting and engaging way to understand the impact of those factors.

Wider reach

A traditional personal finance book will only find so many people. It may be in libraries and on reading lists, but it’s a limited audience. Successful content marketing can bring financial literacy content to the masses.

Bankrate.com drives more than 18 million website visits a month thanks to strong SEO and informative content. The site covers important content like credit, credit cards, real estate, and more.

Personalized learning

A college class needs to cover all the bases. On the other hand, articles focus on more targeted topics. So, users can pick and choose relevant and helpful information. Adding in content personalization can create even more relevant content.

Personal finance brands tend to target content to specific users based on demographics and behavior. This means people who have shown they have a mortgage will learn more about home ownership. In contrast, people who rent may get more content about saving.

Implementing content marketing in financial literacy initiatives

If your financial literacy program wants to increase reach or engagement, you may want to include some content marketing best practices.

Of course, you could just try writing blogs. But for the most success, make sure to consider these tips:

Understand your audience

When creating a content strategy, it’s best to take a people-first approach. This means making sure your content speaks to your audience on a personal level and that it addresses their needs and wants.

To do this, dig into the audience you have and the audience you want. You’ll want to understand their desires and pain points. To learn more about your audience, look at:

- Past and current website visitors

- Customer surveys

- Feedback on forms or social media

- Competitor websites and socials

Create engaging and informative content

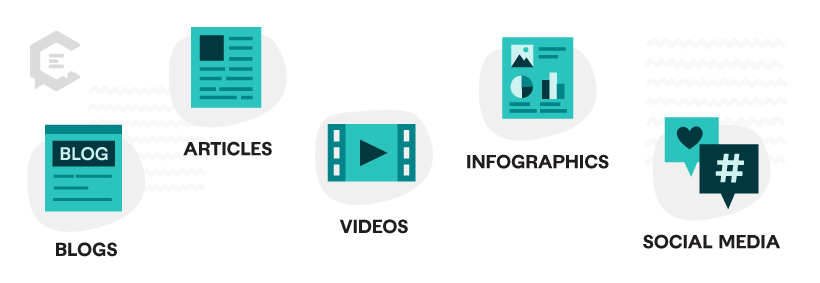

Creating content is the backbone of content marketing. You’ll want to write and produce engaging, informative, and maybe even entertaining content.

This could mean creating:

- Blogs

- Articles

- eBooks

- Videos

- Podcasts

To create content, you’ll need to:

- Ideate: Brainstorm relevant topics to your audience and map them to keywords

- Create: Write, produce, or build the idea

- Revise: Have stakeholders, experts, or company leaders review content for accuracy

- Publish: Set your content into the world

- Amplify: Review for SEO. Promote content on social media. Send this content to your subscribers

Using the right platforms

The right place for your financial literacy content will vary. Your audience, your goals, and your distribution all affect what platforms you use.

When choosing a publishing platform, look to where your target audience spends time and see what matches your content. A long article won’t make sense on Instagram, but an educational infographic likely would. Similarly, a short video doesn’t make sense for a whole webinar, but you could adapt an ebook into one.

The future of content marketing in financial literacy

With the rise in AI programs, voice search, and ever-evolving SEO guidelines, it’s hard to know what the future of content marketing looks like. But when it comes to financial literacy content marketing, people are searching for answers online.

The top 10 Google queries about finances are:

- How can I get rich online?

- How to invest in stocks

- How much house can I afford?

- How can I pay for college without going broke?

- Should I pay off my credit card or save?

- How to get student loans forgiven

- How much do YouTubers make?

- When can I retire?

- How much should I spend on an engagement ring?

- What is the best bank for college students?

Stay informed on content and finance trends

It’s essential to stay ahead of the curve regarding financial literacy content. This means looking at financial information like regulatory changes, market shifts, and common concerns.

It also means embracing online culture and technology. Adapting content marketing to financial literacy may mean:

- Embracing AI

- Testing personalization

- Using data

- Testing new approaches

- Embracing new platforms

Create financial literacy content like a marketer

If you’re working to improve financial literacy, it can feel wrong to use traditional marketing. The goal is to help people save money, not sell to them. However, content marketing is a powerful educational tool.

Successful content marketing can help your financial literacy program:

- Reach more people

- Engage new audiences

- Personalize information

If you’re interested in creating personal finance content, ClearVoice can help. The ClearVoice writer networks include experienced legal and financial writers who know how to write educational finance content for all audiences. Learn more about ClearVoice writers today.